2000: Not until we are completely lost, or turned round, –for a man needs only to be turned round once with his eyes shut in this world to be lost, –do we appreciate the vastness and strangeness of Nature.

–Henry David Thoreau, Walden (Charles E. Merrill Publishing Co., Columbus, Ohio, 1969), p. 185.

-

Summon Your Courage and Buy Stocks

Investors who conquer stock-phobia have an edge over those too focused on their rearview mirror By Jason Zweig 2025: Oct. 4, 2008 12:01 am ET During the Great…

Latest articles

-

What’s Luck Got to Do with It?

-

You’re Not Paranoid. The Market Is Out to Get You.

-

Messing Up the Closest Thing to a Sure Thing in the Stock Market

-

What Bill Ackman Got Wrong With His Bungled IPO

-

A Couple Won the Powerball. Investing It Turned Into Tragedy

-

Why Your Fund Manager Can’t Beat Today’s Stock Market

-

Hot Funds and the Curse of ‘Self-Inflated Returns’

-

The Investing Boom That’s Squeezing Some People Dry

-

Thought of the Day

Money in Art, Money in Culture

Books

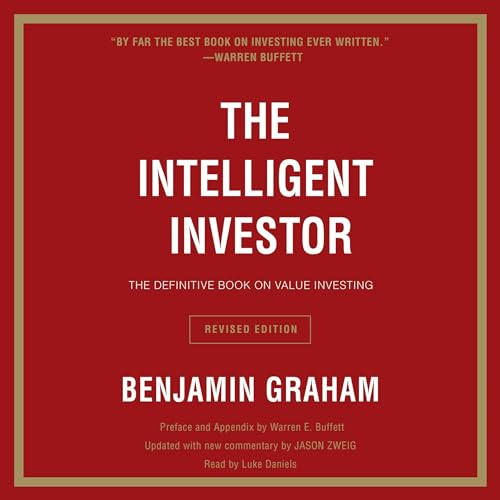

Jason is the author of “Your Money and Your Brain,” on the neuroscience of investing, and the editor of the revised edition of Benjamin Graham’s “The Intelligent Investor,” the classic text that Warren Buffett has described as “by far the best book about investing ever written.”