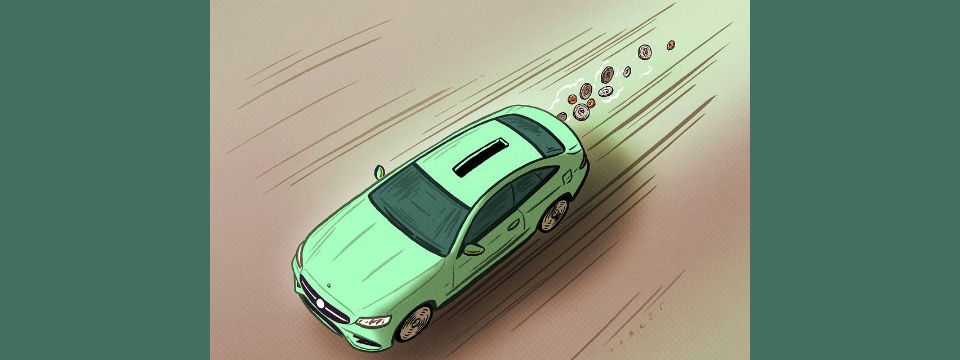

This spring, tens of thousands of people who own or lease a Mercedes-Benz vehicle are receiving an unusual direct-mail offer: an invitation to invest in short-term securities from Mercedes paying a 2.5% annual rate.

That looks like a limousine of yield alongside the jalopy rates of less than 1% you get right now on most bank accounts, certificates of deposit or money-market funds.Whether the Mercedes cash vehicle or others like it are right for you depends primarily on whether you think of cash as an offensive or defensive investing weapon…

Read the rest of the column

This article was originally published on The Wall Street Journal.

Further reading

Jason Zweig, Your Money and Your Brain

Jason Zweig, The Devil’s Financial Dictionary

Benjamin Graham, The Intelligent Investor